Gold mining in Russia by individuals, in other words, by ordinary people-miners, was either encouraged by the state or prohibited. History has shown that by giving gold miners the opportunity to ordinary people to mine gold, the state only benefited from this. Indeed, during the reign of Peter I, most of the large deposits in Russia were discovered by ordinary people.

In many countries, particularly in Africa and Asia, illegal gold miners wash sand and climb into mines, risking their lives. How the state now regulates the activities of individuals in this area in Russia, what needs to be done now in order for individuals to be able to extract this precious metal legally, we will consider in more detail in this article.

Is gold mining by private individuals allowed in Russia - historical background on the legalization of mining

Until 2016, Russians were prohibited from mining gold on their own. Already in 2022, a bill has been developed allowing private owners to engage in mining.

Turning to history, it should be noted that gold mining is considered a medieval craft for the population of Russia, Kazakhstan, Australia, the USA and many other countries. Previously, there were no search restrictions. In the 19th century, the country had only a few known deposits in Siberia and the Urals. Gold miners came to Russia from remote regions to try their luck.

History of private gold mining during the USSR

A definite problem is the lack of significant experience in private gold mining. Gold mining in Russia by individuals has not been permitted since 1954. The Stalin era was freer. The state included additional payments for gold miners and gave them the right to develop the richest gold mines. To intensify labor, they distributed housing, vouchers to sanatoriums, etc. Before the Great Patriotic War, every resident of the country over 18 years of age who had not previously received a criminal punishment had the right to work as a miner. The number of gold miners operating separately or in non-governmental organizations reached 120 thousand.

The resulting gold was handed over to countless specialized points. Gold mining in Russia at mines by private individuals, their discovery has brought significant benefits. Then the deposits became state owned. The precious metal in Russia was mainly obtained in the east: in the Urals, in Siberia, where the Bolsheviks did not immediately find themselves after the revolution. Gold mining enterprises found themselves in the hands of one political force, then another. The losers, when leaving, destroyed equipment, disabled mines, and did not allow workers to function.

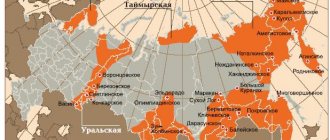

The main gold deposits in Russia

Throughout the Russian Federation there are about 1000 sites where gold is found. 15 regions are allocated for industrial production. 10 regions do not allow us to predict the volumes of metal mined. The country's largest gold deposits are:

- Fedorova Tundra;

- Lyubash-1;

- Urupskoe;

- Khudesskoe;

- R. Tavrota;

- R. Balbanyu;

- Berezovskoe;

- Maminskoe;

- R. Miass;

- Tominskoe;

- Kochkarovskoe;

- Svetlinskoe;

- Murtykty;

- Zapadno-Ozernoe;

- Novo-Uchalinskoe;

- Uzelginskoe;

- Chebachye;

- Mikheevskoe;

- Yubileiny;

- Podolsk;

- Komsomolskoe;

- Gayskoe;

- Vasin;

- Oktyabrskoe;

- Talnakhskoe;

- Norilsk-1;

- Maslovskoe;

- Golden;

- High;

- Blagodatnoe;

- Olimpiadinskoe;

- Titimukhta;

- White Mountain;

- Multivertex;

- Perevalnoe;

- Light;

- Ak-Sugskoe;

- Devil's Trough;

- Adjacent plot;

- Verninskoe;

- Sukhoi Log;

- Ugahan;

- R. Chayangro;

- Kholodninskoe;

- Delbe;

- Central;

- Rowan;

- Kurung;

- R. Kuranakh;

- R. Seligdar;

- R. Bol. Kuranakh;

- R. Bol. Tyrkanda;

- Gross;

- Bamskoe;

- Berezitovoe;

- Klyucheskoe;

- Ithakinskoe;

- Alexandrovskoe;

- Talatuiskoe;

- Darasunskoe;

- Baleyskoe;

- Taseevskoe;

- Novo-Shirokinskoe;

- Bystrinskoe;

- Kultuminskoe;

- Silver;

- Ikanskoe;

- Malomyrskoe;

- Albynskoe;

- Malmyzhskoe;

- Albazinskoe;

- Khakanja;

- Nezhdaninskoe;

- Kyuchus;

- Placer Camus;

- Placer Chugas;

- Drazhnoe;

- R. Berelech;

- Dry Ruslo Stream;

- Sturmovskoe;

- Pavlik;

- Degdekanskoe;

- Natalka;

- Dukatskoe;

- Rolling;

- Irbychan;

- Birkachan;

- Maple;

- Gerbil;

- Kekura;

- Dome;

- Double;

- R. Chaanay;

- Mayskoe;

- R. Nutekingenkyveem;

- Amethyst;

- Kumroch;

- Aginskoe;

- Rodnikovoe;

- Veduginskoe;

- Panimba;

- Bogolyubovskoe;

- Poputninskoe;

- Kingashskoe;

- Novo-Urskoe;

- Baranevskoe.

Mining gold in the river

Mining machines

Gold mining machines

Sometimes gold rock is mined using floating mining machines, which ensure complete mechanization of the process due to the dredging and processing equipment they have. These devices are called “Dredges”, they enrich minerals and remove waste rock.

What are these machines for? Raw materials are not always found on land. Dredges develop flooded areas and extract valuable raw materials. They are used in alluvial, deluvial, coastal-marine, sedimentary, placer areas. They are not used in viscous clay.

Humanity has been mining valuable rocks since ancient times. Gold mining is an important basis for the financial structure of any country, as gold is a universal and stable currency. There are currently 16 registered companies specializing in this area in the Russian Federation. The largest among them is Polyus Gold. The main deposits of raw materials are concentrated in the Magadan, Amur and Irkutsk regions, Krasnoyarsk and Khabarovsk territories, and Chukotka.

Polyus Gold

Recent changes in legislation make it possible to obtain a license for metal mining not only for large organizations, but also for individuals. One of the main conditions for obtaining a permit is passing a competition/auction conducted by a government organization. Individual entrepreneurs are limited to a number of prohibitions when carrying out work.

Why and where individuals were allowed to mine gold

Previously, citizens were not allowed to excavate gold on their own. Now this is allowed, but with a number of restrictions. For such activities, individuals are required to obtain a license that will allow metal laundering in areas of no more than 150 thousand square meters. within 5 years.

Russia has enormous potential for the development of gold mining tourism. In many regions there are mineralogical areas that are not of interest to legal entities in terms of industrial scale gold mining. But they could become bait for prospectors.

Organizing tours to places attractive to tourists means the creation of new jobs and financial profit for the regional budget. While vacationers who bought a tour would have the opportunity to search and launder gold and other stones, paying for equipment and licenses.

Modern times

In recent decades, some changes in the field of gold mining have occurred. Against the backdrop of ongoing changes at the present stage, strict restrictions in gold mining do not seem entirely logical and understandable. Gold mining in Russia by individuals required a license. Gold mining and its licensing are limited by the Federal Law “On Subsoil” No. 2395-1, which was included in those in force in the first year of the existence of the Russian state, and the Federal Law “On Precious Metals and Precious Stones” No. 41-FZ, put into effect in 1998 .

The law on gold mining in Russia by individuals provides that the extraction of gold is carried out only by legal entities who have taken permission (license). The government agency distributing licenses is the Federal Agency for Subsoil Use - Rosnedra and its organizations in the provinces. A permit is required for gold mining in Russia by individuals.

Basic requirements for legal private gold mining

- IP registration. People who want to independently engage in gold mining must obtain the status of an individual entrepreneur;

- obtaining a license. The document gives the right to choose an area of no more than 150 thousand square meters;

- surface method of gold mining. Miners are prohibited from using heavy equipment and only surface search tools are permitted;

- ban on blasting. Explosives are only permitted for use in the Far East as a pilot project;

- prohibition on hiring hired labor. An individual entrepreneur must carry out excavations independently, without hired employees;

- outside the zone of industrial gold mining. Work is carried out only in areas that are not subject to industrial processing. There are such areas in the Magadan region;

- restrictions on the amount of metal mined. An entrepreneur can extract no more than 10 kg of gold from one plot;

- immersion in the ground no more than 5 meters. This allows you to find only native gold located on the surface of the soil or placer gold.

Cost of a mining permit

Permission can be obtained in several ways and in each case the price will be different. How much do you have to pay for the right to mine precious metals, and what are the ways to get it?

Law firms can provide assistance in completing paperwork. In this case, employees of this company will be responsible for collecting papers, filling out documents and visiting the necessary offices. The applicant is only required to pay for the services and be patient. Such a service is not cheap. The entrepreneur will have to pay from 100 to 200 thousand rubles. For comparison:

- from 10 to 100 thousand rubles is the cost of a permit for the development of placers;

- from 15 to 200 thousand US dollars should be paid for the right to mine ore.

You can also obtain permission yourself. In this case, the gold miner will be able to significantly reduce its costs. State fees for obtaining a license can be called very affordable:

- 7500 rubles for the first registration;

- 750 rubles for re-registration, extension and issuance of a duplicate permit.

All current information on the amount of state duties can be found on the website of the Department of Subsoil Use of the Central Federal District.

The total cost of obtaining a license consists of several types of payments:

- fee charged for participation in an auction or competition. Paid when submitting an application and returned only if the auction does not take place for any reason;

- payment for the use of subsoil. Typically 10% of the mineral extraction tax;

- state duty.

Of course, the entrepreneur must decide for himself which way he will go to obtain a special work permit. The smallest expenses, as a rule, are limited to organizations that have received permits based on participation in a competition, which is an alternative to the auction held by the Ministry of Nature.

The fact is that the contestants do not raise the stakes, they fight with each other, offering the state the most favorable terms of the deal. A limited list of gold deposits is usually put up for competition. Most often, many of the objects require geological exploration activities. The investor who won the competition will have to carry them out in a fairly short period of time. Such conditions allow a businessman to seriously save on obtaining a license.

However, it should be remembered that upon becoming a gold miner, an entrepreneur undertakes to pay taxes in the form of:

- annual payments for subsoil use for each square kilometer of the site;

- mineral extraction tax (MET).

Punishment for mining gold worth more than a million rubles

If gold mining in Russia by private individuals is carried out in the amount of 1 million 500 thousand rubles, the violator will face imprisonment and penalties. According to the law, the circulation, transportation, purchase and sale of precious metals in especially large quantities provides for punishment:

- forced labor;

- imprisonment for 5 years and a fine of up to 500 thousand rubles;

- salary deduction for 3 years.

If an offense is committed by a group of persons, a fine of 1 million rubles is applied. or imprisonment for up to 7 years. Similar sanctions are also provided for accidental intrusion into someone else's gold mining site.

Illegal mining of precious metals

Reasons for the continued work of private gold miners

Nevertheless, technical and legal restrictions could not and cannot stop private gold miners. Firstly, not all deposits are suitable for industrial development. Some of them are simply unprofitable - their cost due to relief, geographical and economic conditions is higher than the cost of the production obtained. Large enterprises will not deal with gold in this case. Gold mining in Russia by individuals in small shares is more relevant than large-scale mining. There are many deposits with a small concentration of precious metal; the state not only cannot control them, but sometimes it is not even able to register them. At the beginning of the 21st century, small deposits of gold are being discovered even in regions that have never panned for gold.

Secondly, gold laundering by unorganized miners in abandoned deposits undoubtedly has positive aspects: a “web” of road routes to mining sites, low demands on the professional level of workers, and the potential for using more primitive, inexpensive tools. There is an officially non-operating field in the Amur region. The search for gold went on there for more than a hundred years. However, a large volume of precious metal was raised from the ground, so free miners will find something to look for. Gold mining in Russia by private individuals in abandoned mines is currently increasing.

Procedure for obtaining official permission

How to obtain a gold mining license through official means:

- Registration of the status of individual entrepreneur and official taxpayer. For this you need:

- application in the prescribed form for registration;

- photocopy of passport.

- Site selection through Rosnedra agencies. The individual entrepreneur sends an application for a free territory and expects a response within a month;

- payment of the state fee to obtain a license - 7500 rubles;

- obtaining a license for private entrepreneurs through intermediaries. There are legal entities that help you obtain a license. This option speeds up the process of collecting and filling out documentation. Such a service for individual entrepreneurs will cost 100-200 thousand rubles.

What is required for this

To legally mine gold, a special license is required. But getting it is not easy and not everyone can afford it. Rosnedra puts only certain deposits up for auction. Also, an individual can apply to Rosnedra independently to obtain a license to develop one of the deposits, the list of which is available for anyone to view. Today, more than a hundred such sites are known.

You can engage in mining without a license in the following situations:

- If an individual buys a company that already has the right to gold mining.

- If the individual entrepreneur has signed a contract for the development of “his” plots with a specialized gold mining company.

Licenses issued for an LLC or JSC are of two types:

- are issued for 20 years and allow gold mining;

- are issued for 25 years and involve not only the extraction of precious metals, but also the development of a deposit with mandatory geological exploration.

Individuals with individual entrepreneur status are issued a license only for placer artisanal gold mining. If an individual wants to extract yellow metal by mining or by more modern methods, then he will have to register an enterprise and obtain a license permit for a person with legal status.

For geological exploration, purchasing the necessary equipment and organizing production at a placer mine, you need to have a capital of 10-100 million rubles. If you need to organize a mining company, you will have to invest at least half a billion rubles in the business.

When a license is not required

A gold license may not be required in the following cases:

- purchase or lease of an enterprise with all permits. In this case, it will be necessary to obtain a re-evaluation of the geological information about the deposit from government inspectors;

- work by agreement on the dumps of a gold mining enterprise. Private individuals can legally mine precious metals by concluding an agreement with gold mining companies. Often companies sell for a certain percentage the opportunity to develop their subsoil or areas where deposits do not allow for industrial production. But it is quite difficult for beginners to cooperate with such companies. More often than not, all the “good” sites are taken apart by former employees and partners of companies.

Bypassing the license

But what to do if the golden sparkle in your eyes is already preventing you from sleeping at night, but for one reason or another it is not possible for you to obtain a license? There is another way. You need to find a company that mines gold. Agree with its representatives to assign you a “workplace” somewhere on the dumps of their company. It is possible in those places where there is enough gold for one person, but the development of this place on an industrial scale is no longer profitable.

Naturally, the company should have obvious benefits from cooperation with you. And what could be more obvious than the percentage of profit from any substance you extract? In general, this scheme is realistic and justifies itself. However, it is quite rare. This is because such “breadcrumbs” from the “tables” of large companies are collected, most often, by former employees or good friends of members of the same companies. That is, all the hot spots have already been sorted out. But luck is such a thing.

Prospects for the development of private gold mining in Russia

According to the country’s leadership, the legalization of mining should bring the “black” market out of the shadows. The country's budget will be able to officially replenish gold reserves and the financial part, thanks to duty payments. At the same time:

- many new jobs will appear;

- citizens' earnings will increase;

- the population will begin to become more actively involved in one of the most profitable industries in the world.

Antique gold coins and bars

Changes in laws. Gold mining for individual entrepreneurs and individuals

From the moment when amendments were made to the legislative framework, private individuals were allowed to mine gold only in those regions where industrial mining is not carried out. We are also talking about the extraction of valuable minerals, diamonds, and other treasures. The Law on Precious Metals and Minerals does not provide for the right of such mining to private individuals who have the status of individual entrepreneurs without registering a legal entity, but only to enterprises.

Gold mining by private owners can be carried out in volumes that are not comparable to industrial ones. In other words, an individual entrepreneur can mine host rocks, dumps, waste from mining corporations, substandard ore, written-off reserves, deposits of ores and gold sands of loose or bedrock type.

Federal laws regarding precious metals and stones should regulate unreported and untaxed gold mining. However, the voices of will, which are private traders, can hardly compete with large firms. Individual entrepreneurs can work in areas where large-scale mining has already been established or the availability of gold is in question.

Gold mining by individual entrepreneurs in registered areas, from some point of view, makes sense. The amount of metal in them is relatively small. Using industrial capacity to extract 10 grams of ore is, at a minimum, not profitable. But individuals should have quick access to subsoil, benefits and discounts when calculating taxes and fees.

Interesting: How much does a gram of gold cost in a pawnshop?

Metal mining is different from product manufacturing or marketing. Even if all the conditions are met, there may simply be no metal in the ground. On this side, mining is a very risky business.

Why were private owners allowed to mine?

In the Magadan region, one of the richest in gold minerals, there are many abandoned or exhausted sources. If private owners are allowed to mine in these areas, problems with the creation of new jobs in the region can be resolved.

According to statistics from the administration of the Magadan region, approximately 1,500 citizens are employed in the gold mining industry and have ever had such experience. Gold deposits are approximately 900 kg. It is not very profitable for large ones - in rich regions such a catch can be obtained in a month.

Shortcomings of the amendments made to the Russian Law “On Subsoil”

The law, as amended, allows entrepreneurs to engage in official gold mining, but does not allow them to choose the site they like. An individual entrepreneur can carry out such work only on the territory of the Magadan region and using a surface method. However, the gold reserves on Russian territory are huge.

Obviously, not everyone accepted the terms of the law, which led to the development of a market for illegal gold mining. As a result, the state does not receive additional taxes, about 10% of illegal gold passes through the treasury, and “black” miners do not have any social protection.

How is gold extracted from ore?

Most companies today extract gold from ore. This process is carried out in several ways:

- In placers, which is available to ordinary individual entrepreneurs.

- By processing recycled materials.

- Through the development of primary deposits.

- Using artisanal methods, such as water washing and amalgamation.

The most effective way is to develop primary deposits, but it is not available to everyone. In this case, during operation, extraction occurs along with quartz, in the veins of which the precious metal lies.

Handicraft methods will only be effective if expensive structures are used. What methods of this type exist?

- Flushing. It is rarely used, as it requires a lot of physical effort and time.

- Amalgamation. An effective method of extraction, but very expensive. Based on the properties of mercury to form the necessary compounds with gold.

- Cyanidation. Most often used by prospectors. This technique requires the use of hydrocyanic acid, which can dissolve gold.

Before starting gold mining, a prospector must understand that the efficiency of work will depend on the size of the investment. It is not possible to achieve high profits from private activities. A license for individuals is issued for only 5 years, and activities without permits can lead to criminal liability.

Non-industrial gold mining in other countries

Australia is considered an example for many countries in the world. There, the gold miner can obtain permission himself in a few minutes. This license costs only $30. Many tourists try their luck, even with a small chance of finding a precious metal.

Process of extracting gold from natural sources

Mining in the context of invalidity

One of the common and serious mistakes that companies in the field of subsoil use often encounter is concluding a contract that provides for the emergence of ownership of the extracted mineral “immediately” from the contractor. At the same time, the parties do not even suspect that they are signing a void agreement, which not only contradicts the mandatory requirements of the law, but also encroaches on public law interests. In addition, such a transaction is mixed, and if the object of the contract is insufficiently individualized, the contractor may lose both payment and the opportunity to recover unjust enrichment. In this case, the subsoil user has the right not to transfer the extracted mineral resource to a contractor who is insolvent.

What is the difference between underground and mined minerals?

The sphere of subsoil use combines private law and public law relations. In this connection, the contract for the extraction of mineral resources must comply not only with the norms of the Civil Code, but also with other laws: including the provisions of the Law of the Russian Federation of February 21, 1992 No. 2395-1 “On Subsoil”, No. 116-FZ of July 21 1997 “On industrial safety of hazardous production facilities” and NK.

Extraction of mineral resources is impossible without an approved mining project and compliance with industrial safety requirements applied during the creation and construction of a mining facility, which is a dangerous production facility and at the same time one of the results of mining operations. In this regard, not just the general rules of the Civil Code on contracts, but special provisions of construction contracts, Law No. 116-FZ and urban planning legislation should be applied to relations in the extraction of mineral resources, which once again confirms the multi-sectoral legal nature of the contract in question.

According to the law, the subsoil within the borders of Russia and the minerals contained in them are state property. Under the terms of the license, minerals and other resources extracted from the subsoil may be in federal state ownership, the property of constituent entities of the Russian Federation, municipal, private and other forms of ownership (paragraph 3 of article 1.2 of Law No. 2395-1). To extract minerals and transfer them to the subsoil user, license holders may engage third parties on a contractual basis [1].

Thus, mineral resources located in the subsoil and owned by the state, after their extraction, become the property of the persons holding the license. They are not obliged to extract minerals on their own, but have the right to engage other organizations for these purposes on a contract basis. A contractor who does not have a special permit to use subsoil has no right to claim the property of the subsoil user - minerals extracted from the subsoil, including as payment under the contract. As a result of mining operations, the ownership of the mineral is terminated by the state and can only be acquired by the subsoil user.

In this regard, when concluding an agreement, the parties, in order to maintain the legal purity of the transaction, must follow a certain sequence:

- if a subsoil user has engaged a contractor to extract a mineral, the contract must provide for the latter’s obligation to extract the mineral and transfer it to the subsoil user under the relevant act;

- if the parties agreed that the contractor receives the extracted mineral as payment under the contract, then the agreement must include the following condition: the subsoil user is obliged to accept this mineral from the contractor, and then return it back, having documented everything to register the name of the product, its quantity, quality and price.

Taking into account Art. 180 of the Civil Code, the part of the transaction providing that the initial right of ownership of the extracted mineral resource arises from the contractor, is invalid on the basis of Art. 168 and 169 Civil Code. Therefore, it is unacceptable for a situation in which, as a result of the execution of a contract, the subsoil user did not acquire ownership of the extracted mineral resource at least for a “legal second.” Otherwise, there are risks of recognizing such a transaction as void in part and bringing the participants in legal relations to administrative liability: the subsoil user - under Article 7.10 of the Administrative Code for unauthorized assignment of the right to use subsoil, the contractor - under Article 7.3 of the Administrative Code for using subsoil without an appropriate license.

Why a license holder cannot be a “formal” subsoil user

It is impossible to conclude an agreement under the terms of which the contractor acquires and retains ownership of the extracted mineral resource, and the participation of the subsoil user is limited to providing access to the licensed subsoil plot. This may be regarded as the transfer by the subsoil user of all or most of the functions to the contractor, which is the basis for concluding that the transaction is invalid.

At the same time, the current legislation contains at least four grounds for declaring a transaction invalid in the part that provides that the initial right of ownership of the extracted mineral resource arises with the contractor:

- transfer of the acquired right to use subsoil plots to third parties, including through the assignment of rights - by virtue of Art. 17.1 of Law No. 2395-1, clause 16.1 of Decree No. 3314-1, clause 1, 2 of Art. 168 Civil Code [2];

- transfer of a subsoil plot for use (lease) to a person who does not have a license - within the meaning of Art. 1.2, para. 1 tbsp. 11 of Law No. 2395-1, paragraph 1, 2 art. 168 Civil Code;

- transfer to the contractor of all or most of the functions (rights and obligations) of the subsoil user within the framework of the granted license (transfer of the contract) in the absence of the consent of the subsoil owner - by virtue of the provisions of Art. 392.3, paragraph 2 of Art. 391 Civil Code, clause 1, 2 art. 168 Civil Code [3];

- bypassing the procedure established by law for obtaining a permit (license) for the right to use subsoil – under Art. 169 Civil Code.

Inequality of counter execution – what are the risks?

Payment by the customer for completed contract work can be made both in cash and in commodity form (transfer of extracted minerals). An agreement under which the contractor, as payment under the contract, receives ownership of the extracted mineral resource, is mixed, and therefore must take into account that the contractor, as a buyer, has an obligation to pay for the purchased mineral resource, and the subsoil user, as a customer, for payment for work performed.

A transaction under the terms of which the contractor/customer extracts a mineral or sells it free of charge or with obvious damage to himself is invalid in the relevant part - unacceptable from the standpoint of Art. 575 of the Civil Code, donation in relations between commercial organizations (Article 168 of the Civil Code) [4].

However, the fact that the contractor mined coal for a certain time, and the subsoil user accepted it according to the relevant act, indicates the consumer value of the asset. Even if the contract is declared invalid in this part, the subsoil user will have to fulfill the liquidation obligation - to pay for the work performed [5]. Until this moment, the mineral resource saved by the customer will be regarded by the courts as unjust enrichment [6].

The party whose behavior showed the will to maintain the validity of the transaction will not be able to challenge it on grounds that this party knew or should have known about when expressing its will (paragraph 4, paragraph 2, article 166 of the Civil Code of the Russian Federation). However, this does not mean that the transaction will not be challenged, since the law gives such a right not only to the parties, but also to the creditors of one of the parties, the arbitration manager, and in certain cases the prosecutor and other public authorities.

Does the contractor have the right not to pay for mining work?

The contractor's demand for the transfer of mineral resources to him, stated within the framework of a mixed agreement, under the terms of which the contractor receives ownership of them as payment under the contract, is a buyer's claim to the seller for the transfer of goods, a certain quantity and quality.

However, the contractor has no right to demand that the subsoil user (seller) fulfill this obligation if it has not legally arisen. The emergence of such an obligation to transfer goods must be preceded by a procedure for agreeing on essential conditions, which the law includes the name and quantity of goods [7].

Taking into account the specifics of legal relations in the field of mining, when starting work, the parties cannot always determine in advance what quantity and quality of minerals they will extract, including based on mining development plans, geological reports and other technical documentation. At the same time, the subject of the agreement can be determined by the actual actions of the parties to the agreement, for example:

– in the contract, the parties determine the abstract quantity and quality of the mineral that will be extracted during the execution of the contract;

– the parties considered it possible to begin execution of the contract;

– during the execution of the contract, the parties had no disagreements regarding the actually defined subject matter of the contract;

– the subsoil user accepted the result of the work performed by the contractor according to the act [8].

In this case, the contract will be considered concluded, and the obligation of the subsoil user to transfer the extracted mineral resource to the contractor as payment for the work performed will arise.

The uncertainty of the result of the work (quantity, quality of the extracted minerals) is the risk of the parties, but for the most part the risk of the contractor, who is responsible to the subsoil user for the result of mining work both as a contractor and as a future buyer (Article 413 of the Civil Code of the Russian Federation). In this regard, the following conditions should become an integral part of the contract:

– the procedure for determining the qualitative characteristics of the extracted mineral by sampling with the involvement of an independent laboratory;

– the cost of work in monetary terms if the contractor receives extracted minerals as payment under the contract;

– the procedure for determining the cost of extracted minerals (including depending on their quality characteristics);

– the procedure for determining the actual amount of extracted minerals.

Agreeing on these conditions will allow the parties to ensure in advance compensation and equality of the parties in legal relations. In this case, the subsoil user will not be able to refuse to fulfill its obligation to transfer the mineral resource, since:

- if the mineral is extracted and meets the conditions of the concluded agreement, such actions will constitute improper fulfillment of the obligation;

- if the mineral is not extracted (not in full, in violation of the plan), and the agreement does not contain the necessary conditions, then unjust enrichment occurs on the side of the subsoil user.

Should the extracted mineral be transferred if the counterparty is not ready to guarantee payment?

If there are circumstances clearly indicating a difficult financial situation for the contractor and a high probability of his violating his payment obligation, the subsoil user has the right not to fulfill his obligation (Articles 328, 405 of the Civil Code).

However, such an action by the subsoil user must be in reasonable balance with the actions of the contractor, who could actually perform part of the work and has the right to claim payment for it. The subsoil user should not expose himself to negative consequences due to a foreseeable violation on the part of the contractor. The contractor should not do this either due to the subsoil user’s refusal to pay for the work actually performed (part of the work). Otherwise, it will lead to a violation of the principle of equivalence of counter-execution. And, ultimately, the contractor will appeal to the subsoil user with a claim either for payment for the work actually performed [9] or for the recovery of losses (Article 15 of the Civil Code).

According to paragraph 3 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 6, 2014 No. 35 “On the consequences of termination of the contract” (hereinafter referred to as “Resolution No. 35”), within the meaning of paragraph 2 of Article 453 of the Civil Code, upon termination of the contract, the obligation of the debtor to perform in the future actions that are subject of the contract (for example, to ship goods under a supply agreement, perform work under a contract, etc.). The terms of the contract, which by their nature imply their application after termination of the contract or are intended to regulate the relations of the parties in the period after termination, remain in effect even after termination of the contract.

However, by virtue of paragraph 5 of Resolution No. 35, if, when considering a dispute related to the termination of an agreement under which one of the parties transferred any property into ownership of the other party, the court found a violation of the equivalence of counter-provisions due to the failure or improper performance of its duties by one of the parties , the party that transferred the property has the right to demand the return of what was transferred to the other party to the extent that this violates the equivalence of the considerations agreed upon by the parties.

Thus, the contractor has the right to demand the transfer of mineral resources in full or in the relevant part if:

– ready to guarantee the fulfillment of the buyer’s obligation to pay for the acquired extracted minerals;

– performed work (part of the work) that the subsoil user did not pay for.

And vice versa, if the contractor’s work has been paid for and there are circumstances that clearly indicate the contractor’s failure to fulfill the counter-obligation to pay, he, based on conscientious and reasonable behavior characteristic of any participant in civil legal relations, has no right to demand that the subsoil user fulfill this obligation.

It is worth mentioning that such provisions of the law, despite their clarity and unambiguity, may not find support from the court. For him, a foreseeable violation does not always matter, and the customer’s inaction to retain the goods is legal only when the contractor has already violated the customer’s rights to pay for the extracted minerals. In order to eliminate future disagreements, an express condition should be included in the text of the contract, according to which the customer, if circumstances arise that clearly indicate the contractor’s failure to fulfill the counter-obligation to pay, has the right to require the contractor to provide evidence of his solvency or security for the obligation. If the contractor violates this obligation (it is better to set a reasonable period), unilaterally declare the termination of the obligation to transfer the goods.

To summarize, I would like to once again focus the attention of readers on the complexity and multi-component legal nature of the contract for the extraction of mineral resources. When concluding such an agreement and, often, balancing between two contractual structures - contract and purchase and sale, the parties, without exaggeration, walk on the “edge of insignificance”. As a result, without maintaining a balance, the parties are left alone with the following problems and risks:

- the risk of the contract being declared void insofar as it provides for the emergence of the contractor's initial ownership of the extracted minerals;

- the risk of recognizing the contract as void in the part that provides that one of the parties fulfills the obligation free of charge or, conversely, at a cost significantly higher than the counter-performance from the other party (a transaction with obvious damage);

- the contractor bears the risk of not receiving the extracted mineral as payment under the contract if the parties do not agree on conditions that allow individualization of its quality and other characteristics;

- the subsoil user bears the risk associated with non-receipt of payment for the goods (mined minerals) from the insolvent buyer if he does not promptly request security for the fulfillment of the counter-obligation and does not refuse to fulfill it if the contractor refuses to provide them.

Avoiding these risks when concluding a contract for the extraction of mineral resources will allow a deep and comprehensive analysis of the features of contractual and administrative legal relations in the field of subsoil use.

Authors:

List of sources:

[1] clause 16.1 of the Resolution of the Armed Forces of the Russian Federation dated July 15, 1992 No. 3314-1 “On the procedure for enacting the Regulations on the procedure for licensing the use of subsoil.”

[2] Similar conclusions are contained in the Resolution of the Supreme Court of the Supreme Soviet of July 28, 2020 in case No. A58-12965/2018.

[3] A similar explanation is given in paragraph 73 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated June 23, 2015 No. 25 “On the application by courts of certain provisions of Section I of Part One of the Civil Code of the Russian Federation”, Determination of the SKES of the Armed Forces of the Russian Federation dated September 1, 2020 No. 305-ES20-6940 on case No. A41-51209/2019, Determination of the SKES RF Armed Forces dated July 26, 2016 No. 302-ES15-19746.

[4] A similar position is contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/11/2014 No. 13846/13, Resolution of the Supreme Arbitration Court of the Russian Federation dated 10/04/2019 No. F01-3684/2019 in case No. A29-5490/2016, Resolution of the Supreme Arbitration Court No. of 11/13/2019 F04-5140/2019 in case No. A45-47847/2018.

[5] clause 2 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 No. 51 “Review of the practice of resolving disputes under construction contracts.”

[6] Egorov A.V. Unilateral refusal of the customer from the contract: focusing on practice problems // Bulletin of Civil Law. 2022. No. 3. P. 53–102.

[7] Resolution of the AS SKO dated July 12, 2019 No. F08-4736/2019 in case No. A53-19968/2018; Resolution of the AS CO dated March 29, 2017 No. F10-614/2017 in case No. A14-5160/2016; Determination of the Supreme Arbitration Court of the Russian Federation dated November 21, 2013 No. VAS-16646/13 in case No. A07-15881/2012.

[8] clause 5 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 51.

[9] paragraph 11 of Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 51.

- Pravo.ru

Section question - answer

How to mine gold in Russia legally?

Dovgopolov Dmitry Vasilveich

Geologist

Private individuals are allowed to extract gold reserves from the bowels of the earth with licenses and in areas allocated by Rosnedra agencies. Individual entrepreneur status is required.

Why is it impossible to mine gold in Russia?

Dovgopolov Dmitry Vasilveich

Geologist

All gold reserves in the soil are the property of the state. This means that the extraction of such metal without documentation is equivalent to the destruction of state property. Moreover, all minerals obtained in the process of industrial activity replenish the gold reserves of the state budget and cannot be a means of enriching individuals.

Cost of a gold mining license?

Dovgopolov Dmitry Vasilveich

Geologist

You can obtain permits yourself or through intermediaries. The cost directly depends on the chosen method.

Forms of activity of gold miners

The field of activity of active and energetic people has always been vast and varied. Gold mining, although dangerous at times, does not necessarily require a high-tech base and large financial resources. Gold mining can be carried out by individuals, large firms, and government agencies. At the same time, the Russian state either took an active role in gold mining or outsourced gold mining in Russia to individuals. At the present stage, corporations such as Kinross Gold, OJSC Yuzhuralzoloto, OJSC Severstal, etc. are mainly involved in gold. Until recently, gold mining in Russia by individuals was practiced in much smaller volumes.

Reviews from miners

Private owners are allowed to work in areas where there is no industrial activity. At the same time, restrictions do not allow maximum development of independent search and full-fledged production. Of course, you don’t have to spend money on expensive equipment, obtaining project documents and hired employees, but the income received does not always justify the time spent.

Nikita German, Dmitrov

Andrey Panteleev, Krasnodar

An individual entrepreneur can produce volumes of gold that are far from industrial. But the proposed areas do not allow for full development of production. Persons who have received a permit can work on dumps, process waste from mining companies, substandard ore, ore deposits and launder gold dust in rivers. But this does not allow us to compete with corporations. As a result, the time and effort spent on preparing all the documents is not financially justified.

Goes the official route

Information about vacant plots can be found in the branches of the Rosnedra agency - this is a federal agency that maintains cadastral records and issues licenses for the extraction of minerals, including precious stones and gold. The agency's branches are located in almost all regional centers of Russia. After reviewing the proposed sites, you need to choose the one that seems most promising to you, pay a state fee of 7,500 rubles and submit an application. There are no auctions or competitions for private owners. The answer, in theory, should come within 30 days.

Of course, there may be pitfalls here. Newcomers are unlikely to be allowed to work in good areas. There are companies that provide services for obtaining a license, their services are valued at 100,000–200,000 rubles, which indicates that their services are used, otherwise such companies simply would not exist.

However, there is a way to become a miner without obtaining a license: to do this you need to enter into an agreement with a gold mining company and, for example, get from them for a certain percentage the opportunity to work on the dumps of an enterprise or where there is not enough gold for the industrial mining method, but there is still a lot for private owner

However, here, most likely, there are difficulties: most likely, such production goes to affiliated persons, for example, former employees of the enterprise or former partners, and it is difficult for a newcomer to get there.

As far as one can judge from the remarks of the miners themselves on the Internet, the majority of private traders are dissatisfied with the new law - many hoped that the “free supply” of gold by miners to state buyers would be allowed, that is, the method by which gold miners pay taxes upon the fact of extracting the precious metal.

If you managed to get a license, it’s too early to rejoice - firstly, most of the sites are really in remote places, where “half a heifer and a ruble are transported.” Secondly, in addition to income tax, you will have to pay mineral extraction tax. Thirdly, you will have to worry about prospecting for gold in your chosen area - it may not be there, and you will be burned out.

Well, then you should remember that you yourself will have to worry about your own safety, protect yourself from bears, and the mined gold from people. You will find mosquitoes, midges, ticks, animals, cold nights, spending the night in a scarf, meetings with unpleasant people, disagreements with locals, possibly snowfalls and a very short season, because in the north summer lasts only three months: it begins in June and ends In the end of August.

But if difficulties only fuel the desire to get rich, and you are healthy, full of enthusiasm and, most importantly, know geology well, you can try.