925 silver price per gram in 2022

The cost of 925 silver per 1 gram depends on the method of its sale, the product and the possibility of subsequent redemption. So 925 silver, the price per gram in which is the lowest in a pawn shop, today costs about 18-21 rubles. While in purchases it ranges from 26 to 31 rubles. This difference is due to the economic risks of the organization purchasing the precious metal. It is no secret that a clear advantage of pawnshops was and remains the possibility of subsequent repurchase of the product. Purchases do not provide such an opportunity. And the need for pawning or selling jewelry can be different, as well as the role of this product in a person’s life. Hence the clear advantage of buying in price.

Purchasing jewelry or 925 silverware will be much more expensive for the buyer, since stores sell ready-made jewelry or other silver products at a price of about 600 rubles per 1 gram. These are the indicators of today, at a time when the price of 925 silver on the stock exchange per gram is 34 rubles 51 kopecks.

925 silver in a pawn shop costs about 18-21 rubles per gram

In specialized purchases without the possibility of redemption - 26-31 rubles. for 1 gram

In jewelry stores, jewelry costs 600 rubles and more per gram

With such a spread in prices, manipulations are currently taking place in the field of purchase and sale of precious metals. Each price is economically justified, and the consumer independently decides whether to agree to these market conditions or not. In any case, this practice takes place not only today, but also in the deep past, when the activity of buying and selling jewelry, coins and cutlery made of gold and silver was just in its infancy.

Sterling silver 925, the price per gram of which, as it turned out, consists of a number of indicators, is a fairly high and popular variety of the precious metal. In terms of its composition and the presence of additional elements, such a product will be one of the best and most expensive even after a certain period of time. Therefore, the feasibility of investing in precious metals has been proven for hundreds of years and still occupies a leading position among the chosen methods of storing savings.

How to calculate the value of silver yourself

Information on the price of silver is updated daily. Just like the prices of other assets - gold, securities, currency, oil. The Bank of Russia publishes current information every weekday.

In order to independently calculate the cost of 1 gram of silver in jewelry or cutlery, you will need to multiply the price by the sample. For example, the cost of a 925 silver ring weighing 10 grams as of 02/05/2020 will be:

36.24 rubles * 0.925 * 10 grams = 335.22 rubles, the cost of 1 gram of silver will be 33.52 rubles.

But it’s impossible to buy a new silver jewelry or spoon for that kind of money. This happens because the price includes not only the official cost of the precious metal spent on the product, but also other components. For example, it is influenced by the country of origin, the appearance of the product, the price of other metals included in the alloy and other factors.

What determines the price of silver?

Those who are faced with the need to sell precious metals are interested in how much a gram will cost. Several factors influence the cost:

- fineness or percentage of pure metal in an alloy

- weight of the product (selling in bulk is always more profitable, you can count on setting the price individually)

- value (an old silver fifty-kopeck piece or collectible coins are valued significantly higher, since historical, numismatic, and antique value is added to the value of the metal)

- internal policy and reputation of the company/pawnshop

Silver Futures Analysis

Mathematical analysis of the main Forex instruments Viktor Pankov – 03/11/20211

We present to your attention a mathematical analysis of currency instruments S&P 500, EUR/USD, GBP/USD, USD/CAD, USD/JPY, USD/CHF, AUD/USD, NZD/USD, GOLD , SILVER, BRENT, USD/RUB with…

Jump in oil prices thanks to OPEC+; difficulties in other commoditiesOle Slot Hansen - 03/09/2021 The almost synchronous rally in commodities observed in recent months continues to stall due to rising US bond yields, which is leading to a decline in risk...

Weekly technical analysis of financial markets Evgeniy Khalepa – 03/08/20213 Weekly technical analysis of financial markets. Issue No. 18 dated 03/08/2021 Let’s analyze the basic scenarios for assets in financial markets, namely: goods (gas, oil, gold,…

925 sterling silver - what is it?

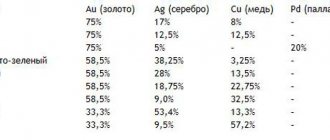

925 silver is one of the highest quality and is widely used in Russia abroad. The composition of the 925 silver alloy includes 92.5% pure precious metal, the remaining 7.5% is copper. This ligature was approved by a single GOST back in Soviet times. Copper imparts the required strength to the metal and significantly improves its characteristics. Less commonly, platinum is used as an additive. Due to this expensive component, the properties of silver are improved, it acquires a snow-white color and its oxidation is significantly reduced. In modern production, palladium, which belongs to the platinum group, and cadmium can be used as an additional element. Jewelry made from an alloy containing platinum or palladium has a higher price. Thanks to this noble metal, the jewelry becomes dazzling white, with an incredible blue cold tint.

When using 7.5% zinc as an alloy, the silver turns out cloudy, but the alloy is incredibly durable and low in price. Zinc is rarely used as an additional component, as it often causes allergic reactions. In addition, silver jewelry is sometimes plated with rhodium, just like white gold jewelry, to add a snow-white color and shine. Another advantage of rhodium plating is the resistance of products to oxidation in air; such jewelry does not darken. The disadvantages include the fact that rhodium wears off over time and needs to be coated again, which is very expensive.

925 standard metal is used to make jewelry, cutlery, souvenirs, commemorative medals, and table setting items. In addition, the alloy has found application in electrical engineering.

The relationship between sample and price

Silver bullion is not used for smelting and creating jewelry due to the high ductility of the metal. Therefore, bullion is often purchased for storage, with the prospect of an increase in the price of the precious metal, or to emphasize personal status.

To increase the hardness of argentum, impurities of copper, nickel, platinum or other less noble metals are added to the alloy. The percentage of impurities affects the final silver sample. The more other chemical elements there are, the lower the specific gravity of the precious metal and the lower the cost of the bar or jewelry.

What standard of silver items should you invest in?

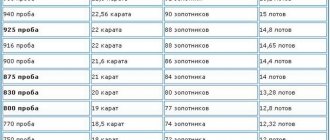

| Try | Description |

| 999 | Maximum content of pure silver. Sometimes 99.9 is written on bars. There is no higher standard. There are practically no foreign impurities in such a metal. It has the highest price. |

| 960 | As a percentage, the alloy contains 4% copper or nickel. Expensive jewelry is made from metal of this standard. But more often it is used for souvenir spoons, church paraphernalia, water ionizers and highly artistic decor. Silver of this standard has a pronounced antibacterial effect, so the products have double value. The cost of argentum 960 is slightly lower than for bars of the highest category. |

| 925 | Silver of this standard contains up to 7.5% copper, nickel or any other alloying metal. It is from such alloys that most jewelry is created. The metal is harder, more elastic and holds its shape well, which increases wear resistance with constant use. To increase the anti-corrosion effect, resistance to oxidative processes and maximum shine, most jewelry is coated with a layer of white rhodium. This treatment increases the cost and improves the physical properties of the metal. The cost of the finished product is influenced not only by the price of silver, but also by the complexity of the work, piece size, exclusivity or the name of the master. In addition to jewelry, 925 sterling silver is used for expensive interior items, cutlery, coins, medals and memorable signs. |

All silver items from 999 to 925 are priced at the highest value for this precious metal.

Which type of products are less attractive for investment?

The more impurities in silver, the less valued it is by both jewelers and buyers. However, some items may be of high value, but this is rarely explained by the precious metal content.

| Try | Description |

| 875 or 84 | Less popular than 925, but also used by jewelers. Contains 12.5% impurities, most often copper, silicon, germanium or platinum. In addition to jewelry, alloys are used for industrial purposes. It is used to create household items, dishes, medals, coins and other less expensive products. If the composition contains platinum, this leads to an increase in the price of the finished product. On ancient products you can find the marking 84, it is equivalent to the modern 875 standard. Such products are of greater value, but not because of the silver content in them, but rather as a rarity or a collector's item. |

| 830 and 800 | This test is rarely found on jewelry. The metal is initially distinguished by a slight yellowness, which reveals a large amount of impurities of 17-20%. Silver quickly oxidizes - turns black, yellow, red or green, depending on which metal predominates in its composition. It is much more often used for inexpensive cutlery or industrial purposes. |

All silver items are marked. In Russia, marking consists of three elements - the symbols of the state inspectorate for assay supervision, the mark of the assay certificate and the sample number.

What affects the price and exchange rate of silver

The price of one gram of silver depends on:

- Cost of raw materials . It does not change depending on where the metal was mined in Europe or America.

- Demand for metal . In industry, medicine, jewelry and any other industries where it is purchased and used.

- Exchange rates . Quotes for the currencies of those world leaders whose reserves hold a large volume of this precious metal also affect the price of silver.

- Key rates of central banks of leading countries . When rates at major banks in major economies fall or rise, the price of silver also changes.

- Amounts of metal on the planet . The total volume of Argentum deposits, according to US estimates, is 512 tons. Most of it is concentrated in Peru - up to 23%, another 14% in Chile, Poland and Austria, 7% in Mexico and 5% in the USA.

According to experts, the development of silver deposits will be completed within the next 20 years. It is then that demand will begin to increase, since at the moment no widespread alternative has been found. In some industries, artificial alloys are already used instead of silver, while in other areas such “substitutes” cannot perform the functions assigned to them. In this regard, investors see a certain perspective in this asset, as in any other asset that physically cannot remain infinite.

The limited nature of silver gives it added value as a long-term investment. While getting a quick profit from investing in precious metals is less likely.

Procedure for handing over jewelry at pawnshop offices

Scrap silver is accepted quickly enough, the procedure itself does not take much time.

Before exchanging silver at a pawnshop, you need to decide whether you intend to buy it back in the future.

The procedure then consists of the following steps:

- Buying silver in pawn shops begins with inspecting the product. The appraiser checks whether it is a high-grade metal or is considered scrap of noble elements with the addition of various impurities.

- After determining the sample, the condition of the product is assessed. It should not have damage, chips or cracks.

- After this, the delivered scrap is weighed.

The cost of a gram of silver will depend on the assessment of these characteristics, that is, on the sample, weight, condition of the jewelry, as well as on the conditions under which the scrap is accepted.

Next, a contract is drawn up. The transaction is processed only if you have a passport.

Its form depends on your further actions. But the characteristics of the product and its description must be indicated.

If you plan to further repurchase the jewelry or kitchen set that you are renting out, the agreement is drawn up as for a loan of funds.

In this case, it is necessary to stipulate the period of use of the loan (in most cases it is 1 year, some pawnshop-type offices set an unlimited period), the date by which the jewelry must be redeemed, the interest at which the money is issued (usually 5-7% per month) .

After all conditions preceding acceptance have been agreed upon, an agreement is signed in two copies. One remains in the pawnshop, the other is given to the client. A specified amount of money is also issued. In addition to the contractual agreement, pawnshop offices also provide for the issuance of a pawn ticket. It must be stored until the product is purchased back.

In force majeure circumstances, many pawnshop offices meet their clients halfway and extend the deadline for purchasing jewelry. In this case, you will also have to pay interest at the agreed rate.

If you were unable to redeem the item on time, it becomes the property of the pawnshop.

If there are no plans to buy back silver in the future, the client simply receives a sum of money in his hands, without further obligations.

After the period allotted under the contract for redemption expires, the item becomes the property of the establishment. Further, it is already sold in the public domain and can be purchased, but at a higher cost.

Silver as an investment

There are three ways to invest in silver:

- ingots;

- coins;

- open compulsory medical insurance.

All three methods can be implemented in a bank. Although the first and second may also be offered by other companies that have a license to conduct transactions with precious metals.

Silver bars

Silver bullion is a popular way to purchase the precious metal for investment. This service is provided in Russian and foreign banks. To conclude such transactions, the company receives a license from the Central Bank to conduct transactions with precious metals.

The price of bars of the same weight can be different even in two neighboring banks. This happens because companies independently approve tariff policies and strategies. Therefore, before investing in silver bullion, compare offers from several banks.

In addition, pay attention to three nuances:

- Where will the bullion be stored - at your home or in a bank? An apartment or house will not always be a safe place, which means you will have to spend money on renting a safe deposit box or installing an alarm system.

- Find out if the company buys back silver bars that were previously sold. A number of banks do not have such a service. Or the redemption price of the bullion is very low. This reduces the benefits of investing in precious metals.

- Payment of VAT. When you purchase a silver bar, you will automatically pay 20%, which is included in the price. Therefore, the return on investment already at the time of the transaction is reduced by 1/5 of the cost.

Silver bars are standard and measured. The latter produce different weights - from 50 to 3200 grams. Each bar is supplied with a manufacturer's certificate, which should be kept nearby. If a document is lost, the value of the precious metal decreases, as does chips, deformations or scratches.

Silver coins

Coins made of silver and other precious metals can be purchased at a bank or numismatic store. VAT does not apply to such goods. Therefore, the final cost of the metal in a coin may be more profitable than in an ingot. In addition, coins are more likely than bars to appreciate in value over time due to their numismatic and collector's value.

Purchase and sale are carried out with commemorative, investment and exclusive coins, which contain silver or other precious metals. However, coins do not have such high liquidity as, for example, bullion. That is, buying a coin turns out to be easier than selling it. Banks either do not buy coins back at all, or the price for them is lower than when purchased.

To find a true connoisseur or collector who will appreciate the piece, you will need to study a lot of information. Therefore, this method of investing is not suitable for everyone.

However, with bullion coins the situation is different. Most often, banks buy back such products more readily, and their value grows much faster than that of the metal itself. Therefore, investing in investment silver coins can be a profitable alternative compared to an impersonal metal account or bullion.

Compulsory medical insurance

An unallocated metal account, or IMA , is a common method of investing in silver. The principle of operation resembles a foreign exchange account, but it stores not money, but precious metal.

A distinctive feature of compulsory medical insurance is that the exchange rate value of silver does not depend on the individual characteristics of the bullion, which include the purity, manufacturer and license plate. That is why it is impersonal because it has nothing to do with the identity of the account owner. It is in this regard that the account is individual and issued to a specific client.

When you open a compulsory medical insurance, you will not be given a silver bar in your hands. This means that it will not wear out, deteriorate, disappear or lose its original characteristics. You do not need to rent a safe deposit box or install an alarm system in your apartment. In addition, with this type of transaction, VAT is not charged, which means that buying silver through compulsory medical insurance is initially 20% more profitable than buying a bullion.

The account can be replenished at any time, as well as closed without losses or penalties. Some companies give the right to partially withdraw or use funds from the account. According to the observations of employees of the banking sector, compulsory medical insurance is opened in silver less often than in gold, but much more often than in palladium or platinum.

Transportation

The company has been accepting scrap silver in any quantity since 2009. Our branches operate in Moscow, St. Petersburg, Bryansk, Kostroma, Novosibirsk and Kaliningrad. Possible delivery by postal company -

one of three

, with whom we cooperate. Transportation is carried out in guarded vehicles.

*Dear Clients! We kindly ask you to bring scrap silver items free of stones. Otherwise, admission will be denied

How to earn more on compulsory medical insurance

The exchange rate for silver, which is stored in the compulsory medical insurance, changes depending on the price set by the Bank of Russia and the exchange rate difference of the servicing bank. Some financial companies offer better prices for precious metals when purchasing large quantities. Check in advance, perhaps your servicing bank is also ready to give a discount when purchasing silver of more than 5-10 kg.

If you make a profit from compulsory medical insurance transactions, then you must pay 13% of the individual’s income. Some banks take on this responsibility. They hold the required amount at the time the funds are transferred to the current account. If your servicing bank does not do this, be sure to pay the tax yourself. Profit from compulsory medical insurance is not subject to taxation if:

- silver was stored in the account for 3 or more years;

- if the total amount of transactions for the sale of silver does not exceed 250 thousand rubles per year.

In the second case, you will still have to report the profit in your income tax return, although no tax will be charged.

Remember! Funds for compulsory medical insurance are not insured. Therefore, if the bank loses its license, it will be impossible to return investments in the precious metal.

How to calculate the cost of a product

Before handing over silver jewelry for purchase with subsequent redemption, a person wonders whether it is possible to independently calculate how much the silver costs on credit. To do this, you can use the following calculation scheme.

Let's say you need to turn in a silver ring. Its weight is 3.5 grams, and its purity is 925. The pawnshop offers to accept jewelry for 30 rubles per gram. Knowing how much 1 gram costs, you can calculate the cost of the entire piece of jewelry. After the assessment, they will be able to offer you 105 rubles for the ring.

In this case, the loan amount will be approximately 71 rubles.

Next, you should calculate the amount of interest that you will have to pay for the fact that the jewelry is being purchased. It will range from 3.5 to 5 rubles depending on the percentage. It follows from this that if you buy back the jewelry after 30 days, you will need to return the amount at which the ring was valued, plus a small percentage.

You can hand over silver jewelry to a pawnshop and receive a certain amount of money at any time. That is why such barter is popular among people.